Title: A Beginner's Guide to Litecoin - Understanding a

Outline:

I. Introduction to Litecoin

II. Understanding Litecoin Technology

III. The Benefits of Litecoin

IV. How to Invest in Litecoin

V. Risks and Concerns with Litecoin Investment

VI. Conclusion

I. Introduction to Litecoin

- Brief history of Litecoin

- Market trends and growth of Litecoin

- Building a case for investing in Litecoin

II. Understanding Litecoin Technology

- Explanation of cryptocurrency

- Comparison between Litecoin and Bitcoin

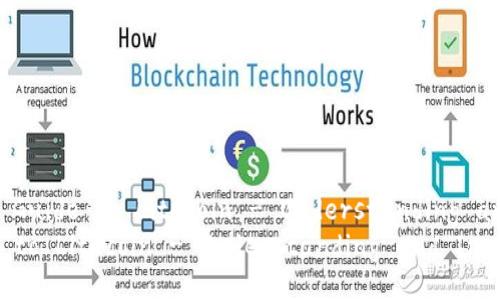

- How Litecoin transactions are processed and verified on the blockchain

III. The Benefits of Litecoin

- Lower transaction fees compared to other cryptocurrencies

- Increased transaction speed for quicker transfers

- Secured and decentralized transactions

- Growing mainstream adoption and acceptance

IV. How to Invest in Litecoin

- Setting up a cryptocurrency wallet

- Choosing a reliable exchange platform

- Safe investment strategies for beginners

- How to buy and sell Litecoin

V. Risks and Concerns with Litecoin Investment

- Volatility and instability of cryptocurrency market

- Security concerns with decentralized transactions

- Regulatory risks and government intervention

- The potential risks of investing in a new and uncertain market

VI. Conclusion

- Recap of benefits and risks of investing in Litecoin

- Final thoughts and recommendations for potential investors

Problem 1: What is Litecoin and how does it differ from other cryptocurrencies?

Investing in Litecoin involves purchasing the cryptocurrency through a cryptocurrency exchange or broker. You will need to set up a cryptocurrency wallet, choose a reputable exchange platform, and determine a safe investment strategy. It is important to be aware of the risks and challenges associated with investing in volatile markets, and to take steps to minimize these risks.

Problem 3: What are the benefits of Litecoin compared to other cryptocurrencies?

Investing in Litecoin involves purchasing the cryptocurrency through a cryptocurrency exchange or broker. You will need to set up a cryptocurrency wallet, choose a reputable exchange platform, and determine a safe investment strategy. It is important to be aware of the risks and challenges associated with investing in volatile markets, and to take steps to minimize these risks.

Problem 3: What are the benefits of Litecoin compared to other cryptocurrencies?

As with any investment, there are risks associated with investing in Litecoin. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly based on shifting market conditions. Additionally, regulatory risks and government intervention can impact the value of Litecoin and other cryptocurrencies. It is important to be aware of these risks and to take steps to manage them effectively.

Problem 5: What are the factors driving the growth and adoption of Litecoin?

As with any investment, there are risks associated with investing in Litecoin. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly based on shifting market conditions. Additionally, regulatory risks and government intervention can impact the value of Litecoin and other cryptocurrencies. It is important to be aware of these risks and to take steps to manage them effectively.

Problem 5: What are the factors driving the growth and adoption of Litecoin?

Understanding Litecoin Technology

Litecoin is a digital currency that operates on a decentralized and open source blockchain technology. It was created in 2011 by Charlie Lee, a former Google engineer, as a way to address some of the limitations and challenges presented by Bitcoin. While it shares many similarities with Bitcoin, Litecoin offers several key advantages that make it attractive to investors. Problem 2: How can someone invest in Litecoin?How to Invest in Litecoin

Investing in Litecoin involves purchasing the cryptocurrency through a cryptocurrency exchange or broker. You will need to set up a cryptocurrency wallet, choose a reputable exchange platform, and determine a safe investment strategy. It is important to be aware of the risks and challenges associated with investing in volatile markets, and to take steps to minimize these risks.

Problem 3: What are the benefits of Litecoin compared to other cryptocurrencies?

Investing in Litecoin involves purchasing the cryptocurrency through a cryptocurrency exchange or broker. You will need to set up a cryptocurrency wallet, choose a reputable exchange platform, and determine a safe investment strategy. It is important to be aware of the risks and challenges associated with investing in volatile markets, and to take steps to minimize these risks.

Problem 3: What are the benefits of Litecoin compared to other cryptocurrencies?

The Benefits of Litecoin

Litecoin is often touted as a faster and cheaper alternative to other cryptocurrencies like Bitcoin. It has lower transaction fees and faster processing times than Bitcoin, making it more efficient for everyday use. Additionally, Litecoin has a strong focus on privacy and security, providing users with greater control over their funds. Problem 4: What are the risks and concerns associated with investing in Litecoin?Risks and Concerns with Litecoin Investment

As with any investment, there are risks associated with investing in Litecoin. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly based on shifting market conditions. Additionally, regulatory risks and government intervention can impact the value of Litecoin and other cryptocurrencies. It is important to be aware of these risks and to take steps to manage them effectively.

Problem 5: What are the factors driving the growth and adoption of Litecoin?

As with any investment, there are risks associated with investing in Litecoin. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly based on shifting market conditions. Additionally, regulatory risks and government intervention can impact the value of Litecoin and other cryptocurrencies. It is important to be aware of these risks and to take steps to manage them effectively.

Problem 5: What are the factors driving the growth and adoption of Litecoin?

The Benefits of Litecoin

Litecoin has experienced significant growth in recent years, driven by a number of factors. These include its focus on privacy and security, lower transaction fees, faster processing times, and growing mainstream adoption and acceptance. Additionally, Litecoin's increasing popularity as an investment vehicle has helped to drive up demand, pushing prices higher and increasing the currency's overall value. Problem 6: How can Litecoin fit into a broader investment portfolio?How to Invest in Litecoin

Like all investments, Litecoin should be approached with a long-term investment strategy in mind. It can potentially add diversification to a portfolio and provide exposure to the rapidly growing cryptocurrency market. However, it is important to carefully manage risk and invest wisely to ensure that Litecoin investment complements, rather than detracts from, a broader investment strategy.